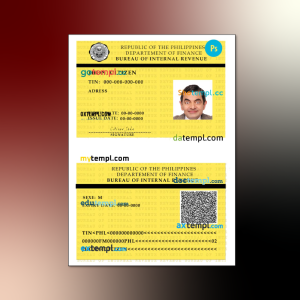

In the realm of taxation, innovation is not often a word that comes to mind. However, the Bureau of Internal Revenue (BIR) has recently introduced a groundbreaking solution that promises to transform the way taxpayers interact with the system—the Bureau of Internal Revenue Card. This little-known gem has the potential to revolutionize tax compliance and streamline administrative processes for individuals and businesses alike.

The BIR card is a smart identification card that serves as an all-in-one tool for taxpayers, providing a seamless experience from filing taxes to accessing various government services. It not only simplifies interactions with the BIR but also acts as a gateway to other government agencies, effectively reducing bureaucratic red tape.

One of the key advantages of the BIR card is its ability to store and retrieve taxpayer information securely. With this card, taxpayers no longer need to repeatedly fill out forms or provide redundant information. By simply swiping their card, their details can be accessed instantly, saving time and reducing the likelihood of errors. This convenience allows taxpayers to focus on more critical aspects of their financial responsibilities. 👌

Moreover, the BIR card enables taxpayers to file and pay their taxes online, making the process more efficient and convenient. Gone are the days of long queues at physical BIR offices. With the card’s integrated features, taxpayers can file returns, settle payments, and track their tax obligations with ease, all from the comfort of their homes or offices. This digital transformation not only improves the taxpayer experience but also enhances the government’s ability to collect revenue more effectively.

Beyond taxation, the BIR card opens doors to a range of government services. It serves as a unified access card, granting users entry to various government facilities and simplifying transactions with other government agencies. From applying for permits and licenses to availing social services, the card’s versatility streamlines bureaucratic processes, reducing paperwork and enhancing overall efficiency. 👀

While the benefits of the BIR card are abundant, it is essential to address potential concerns, such as data privacy and security. The BIR must ensure stringent safeguards to protect taxpayer information and prevent unauthorized access. Transparency and accountability should be at the forefront of this initiative, assuring taxpayers that their personal and financial data will be handled responsibly and in accordance with relevant laws.

The introduction of the Bureau of Internal Revenue Card represents a bold step towards modernizing tax administration and improving government services. By leveraging technology and innovation, the BIR card empowers taxpayers, making compliance easier and more accessible. It is an embodiment of the government’s commitment to efficiency, transparency, and citizen-centric service delivery. 📌

As the BIR card gains traction and becomes more widely adopted, taxpayers can look forward to a future where tax compliance is no longer a burdensome task but a seamless experience. With the power of this card, the relationship between taxpayers and the BIR is set to evolve, fostering trust, efficiency, and mutual benefit.

you can see the editable example here: download

In a rapidly advancing digital era, the Bureau of Internal Revenue Card shines as a beacon of progress, laying the foundation for a more streamlined, technology-driven tax system. It is a transformative tool that paves the way for a future where tax compliance is not only a duty but also an opportunity for growth and prosperity.