A payment receipt is a document that is issued to customers after they have made a payment. This document serves as proof of payment and includes information such as the amount paid, the date of payment, and the method of payment. In this blog article, we will explore the importance of payment receipts and how to properly use them.

What is a payment receipt?

A payment receipt is a document that is given to customers after they have made a payment. It includes information about the payment, such as the amount paid, the date of payment, and the method of payment. Payment receipts can be issued in paper form or electronically, depending on the business’s preference.

Why are payment receipts important?

Payment receipts are important for several reasons, including:

- Proof of payment – Payment receipts serve as proof that a customer has made a payment. This is important for businesses to keep track of their transactions and for customers to have evidence of their payments.

- Refunds and exchanges – Payment receipts are necessary for customers who want to return or exchange an item. Without a payment receipt, a business may not be able to process the refund or exchange.

- Tax purposes – Payment receipts are essential for businesses when filing taxes. They serve as proof of income and expenses and help businesses claim tax deductions.

- Reconciliation – Payment receipts are necessary for businesses to reconcile their accounts. They help businesses keep track of their income and expenses, making it easier to balance their books.

How to use payment receipts

Here are some tips on how to use payment receipts effectively:

- Keep them safe – It’s important to keep payment receipts safe and organized. This will make it easier to find them if needed and help prevent loss or damage.

- Review them carefully – Customers should always review their payment receipts carefully to ensure that the information is correct. This includes the amount paid, the date of payment, and the method of payment.

- Keep them for future reference – Payment receipts should be kept for future reference. This will come in handy if a customer needs to return or exchange an item or for tax purposes.

- Use them for budgeting – Payment receipts can be used to help customers budget their money. By keeping track of their expenses, customers can better manage their finances.

Obtaining payment receipts

Payment receipts can be obtained in several ways, depending on the business’s preference. Customers can ask for a payment receipt at the time of payment, or they may be automatically generated and provided to customers through email or text message. Some businesses may also have a customer portal where customers can access their payment receipts online.

Conclusion

In conclusion, payment receipts are essential documents that serve as proof of payment. They are important for businesses to keep track of their transactions, and for customers to have evidence of their payment. Payment receipts can be used for refunds and exchanges, tax purposes, reconciliation, and budgeting. Customers should review their payment receipts carefully, keep them safe, and use them for future reference.

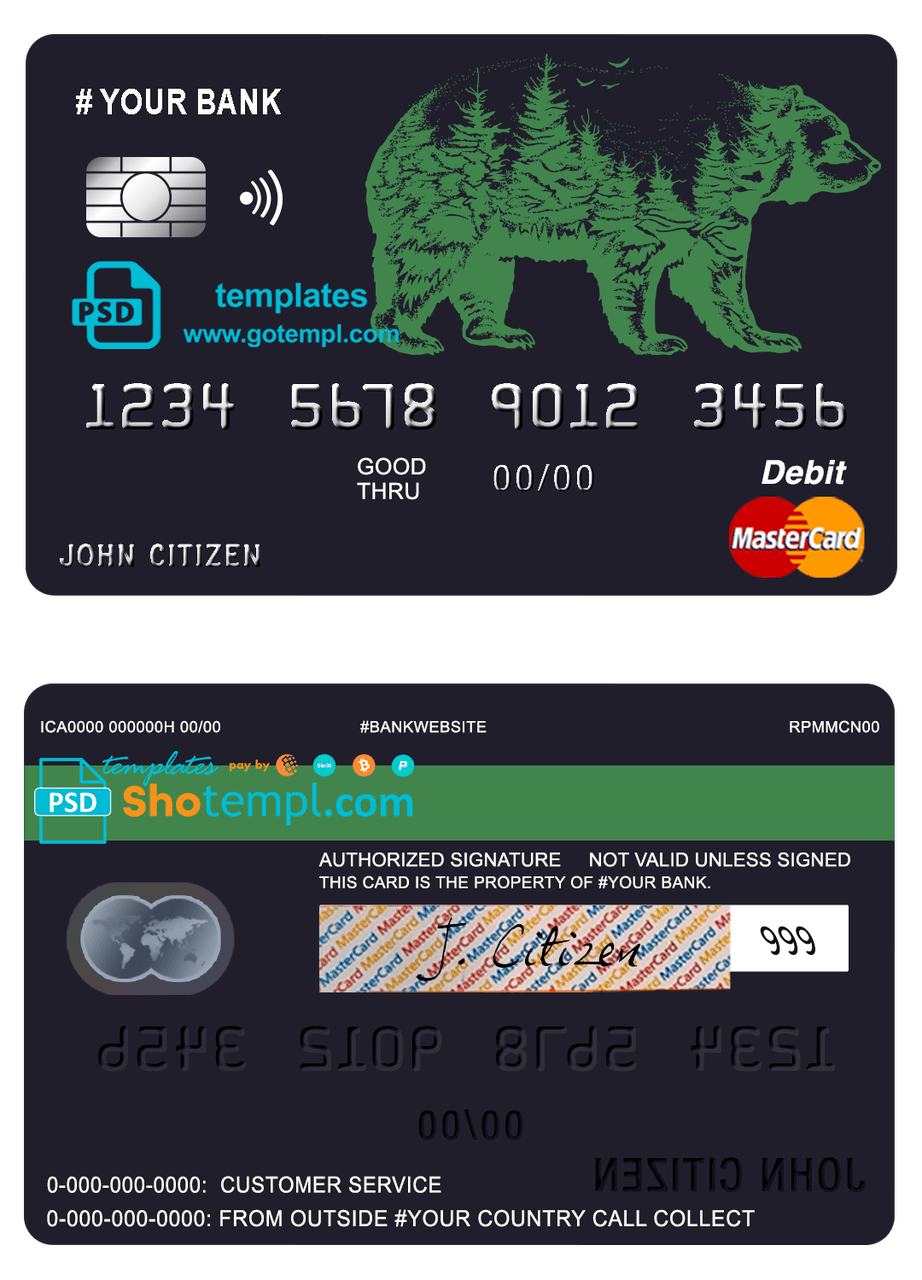

# alpine bear universal multipurpose bank mastercard debit credit card template in PSD format, fully editable

# alpine bear universal multipurpose bank mastercard debit credit card template in PSD format, fully editable  # artsy line universal multipurpose bank visa electron credit card template in PSD format, fully editable

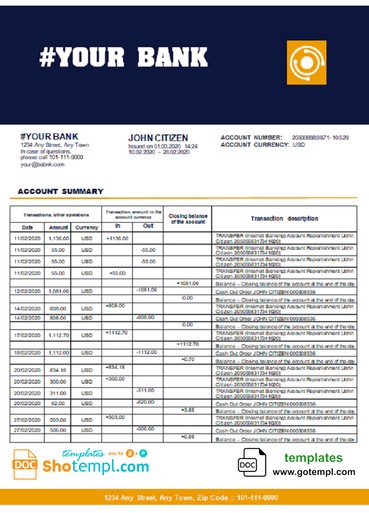

# artsy line universal multipurpose bank visa electron credit card template in PSD format, fully editable  # blue leagcy universal multipurpose bank statement template in Word format

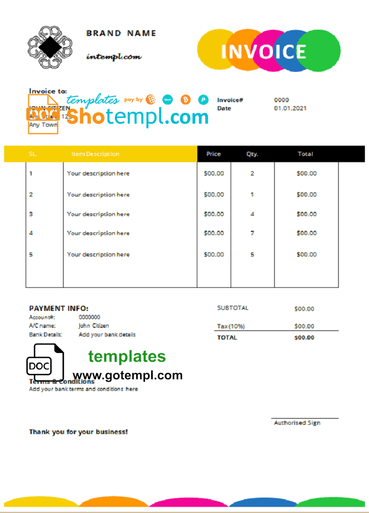

# blue leagcy universal multipurpose bank statement template in Word format  # glow outlook universal multipurpose tax invoice template in Word and PDF format, fully editable

# glow outlook universal multipurpose tax invoice template in Word and PDF format, fully editable