Pay stubs are essential documents that provide employees with a detailed breakdown of their earnings and deductions for a specific pay period. This document is vital as it helps employees understand their pay and ensures that they are being paid accurately and in accordance with employment laws. In this blog article, we will explore the importance of pay stubs and how to read them.

What is a pay stub?

A pay stub is a document that an employer provides to an employee each pay period. It contains information about the employee’s gross pay, deductions, and net pay for the pay period. The gross pay is the total amount of money that the employee earned before any deductions were made. Deductions include taxes, social security, Medicare, and other benefits such as health insurance, retirement contributions, and employee loans. The net pay is the amount of money the employee receives after all deductions have been made.

Why are pay stubs important?

Pay stubs are essential for various reasons, including:

- Verification of earnings – A pay stub helps employees verify that they are being paid accurately and in accordance with their employment agreement.

- Tax purposes – Employees need pay stubs to file their taxes accurately and to ensure they receive the appropriate refunds or owe the correct amount.

- Proof of income – Pay stubs are necessary for individuals who are applying for a loan or a mortgage as they serve as proof of their income.

- Benefits verification – Pay stubs help employees verify that their benefits deductions are correct and that they are enrolled in the correct benefit programs.

How to read a pay stub

Reading a pay stub may seem confusing at first, but with a little bit of guidance, it can be easily understood. Here is a breakdown of the different sections of a pay stub:

- Employee information – This section contains the employee’s name, address, and social security number.

- Pay period information – This section contains the pay period start and end dates.

- Earnings – This section contains the employee’s gross pay and any overtime pay earned during the pay period.

- Deductions – This section contains all the deductions made from the employee’s paycheck, including taxes, social security, Medicare, and benefits deductions.

- Net pay – This section contains the employee’s net pay, which is the amount they will receive after all deductions have been made.

- Year-to-date – This section shows the employee’s earnings and deductions for the year.

Obtaining pay stubs

Employers are required by law to provide employees with a pay stub for each pay period. Employees can obtain their pay stubs from their employer or through an online payroll system. It is essential to review each pay stub to ensure that the earnings and deductions are accurate and to notify your employer of any discrepancies.

Conclusion

In conclusion, pay stubs are essential documents that provide employees with a detailed breakdown of their earnings and deductions for a specific pay period. It is essential to review each pay stub to ensure that the earnings and deductions are accurate and to notify your employer of any discrepancies. Pay stubs serve as proof of income, are necessary for tax purposes, and are essential for verifying employee benefits deductions.

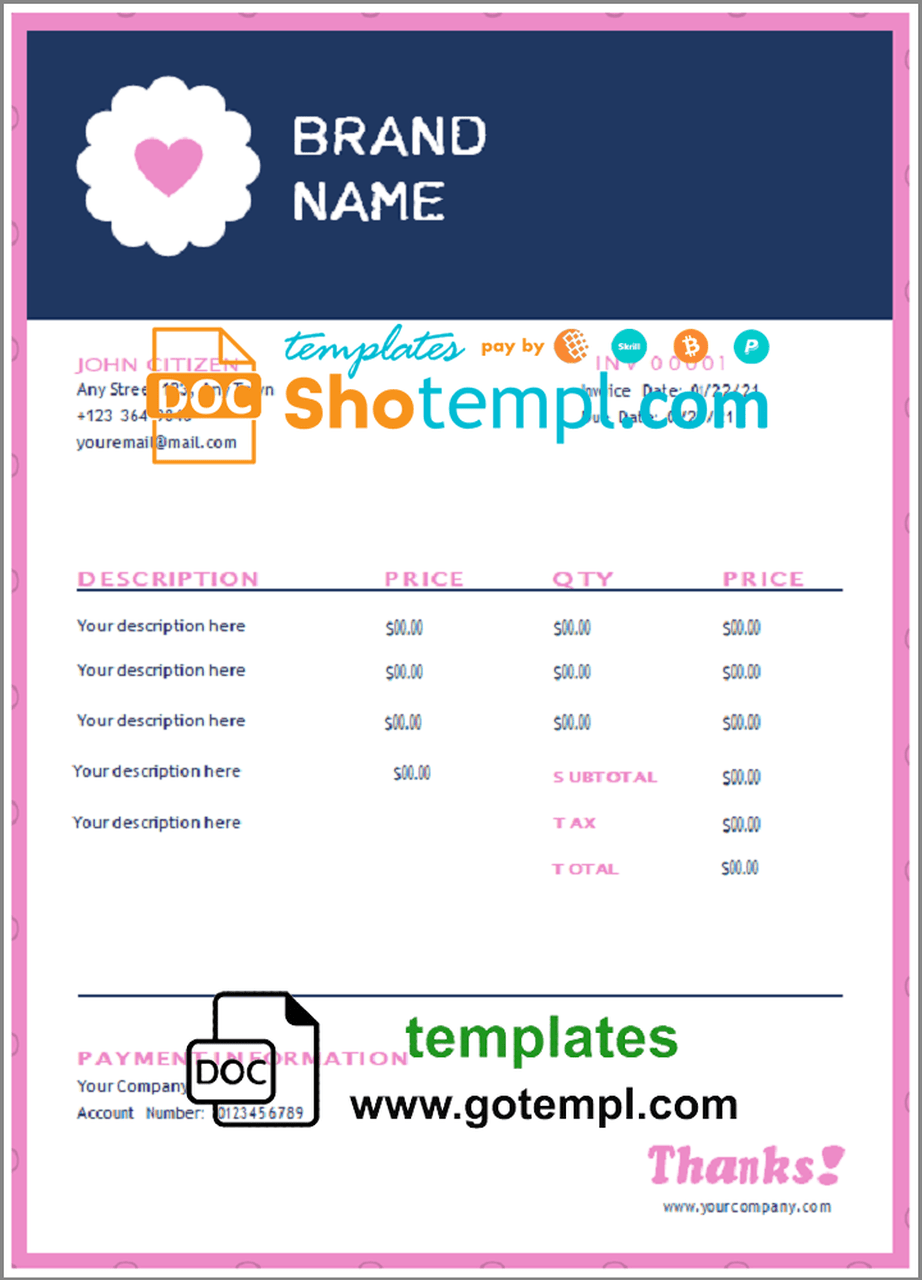

# blush purpose universal multipurpose invoice template in Word and PDF format, fully editable

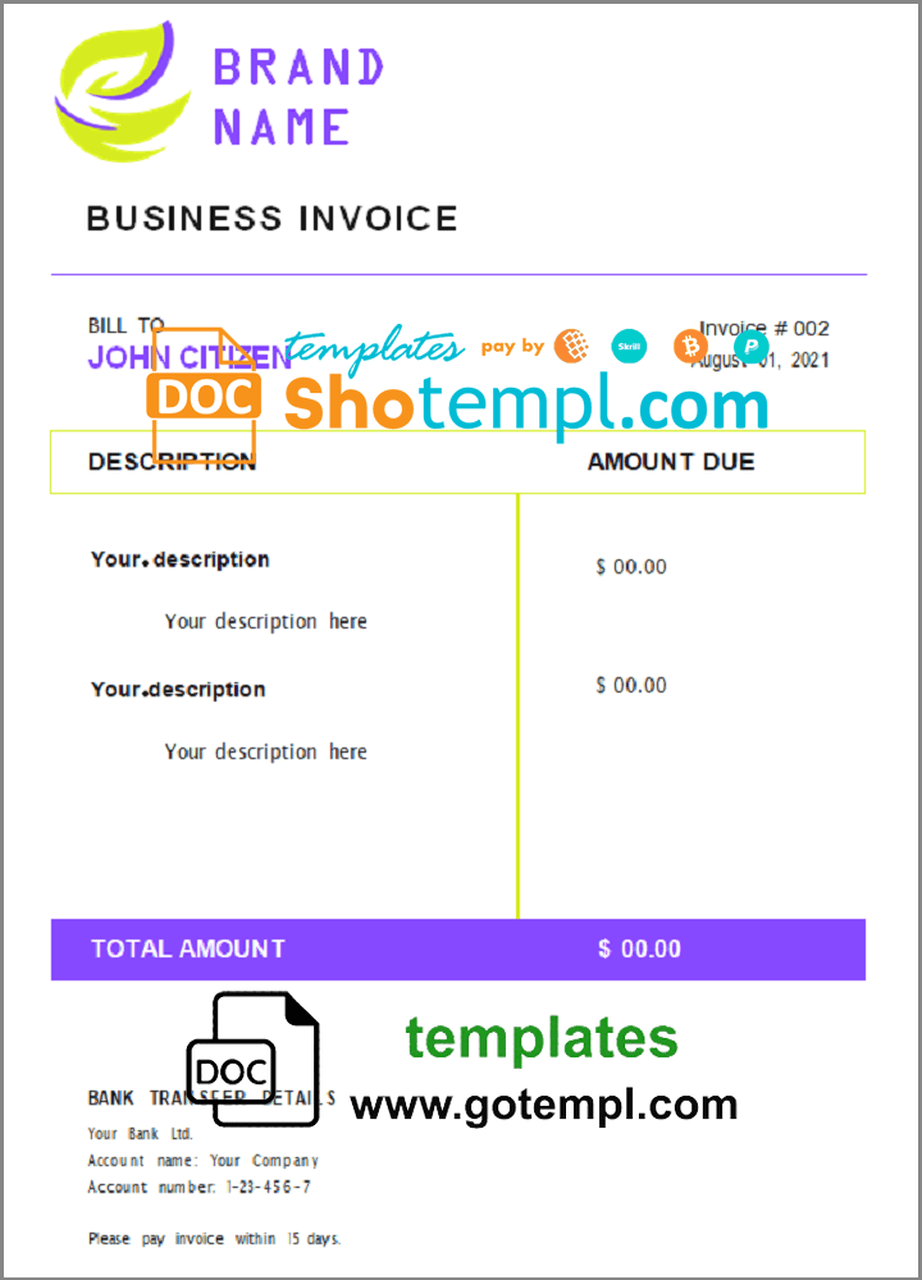

# blush purpose universal multipurpose invoice template in Word and PDF format, fully editable  # head project universal multipurpose invoice template in Word and PDF format, fully editable

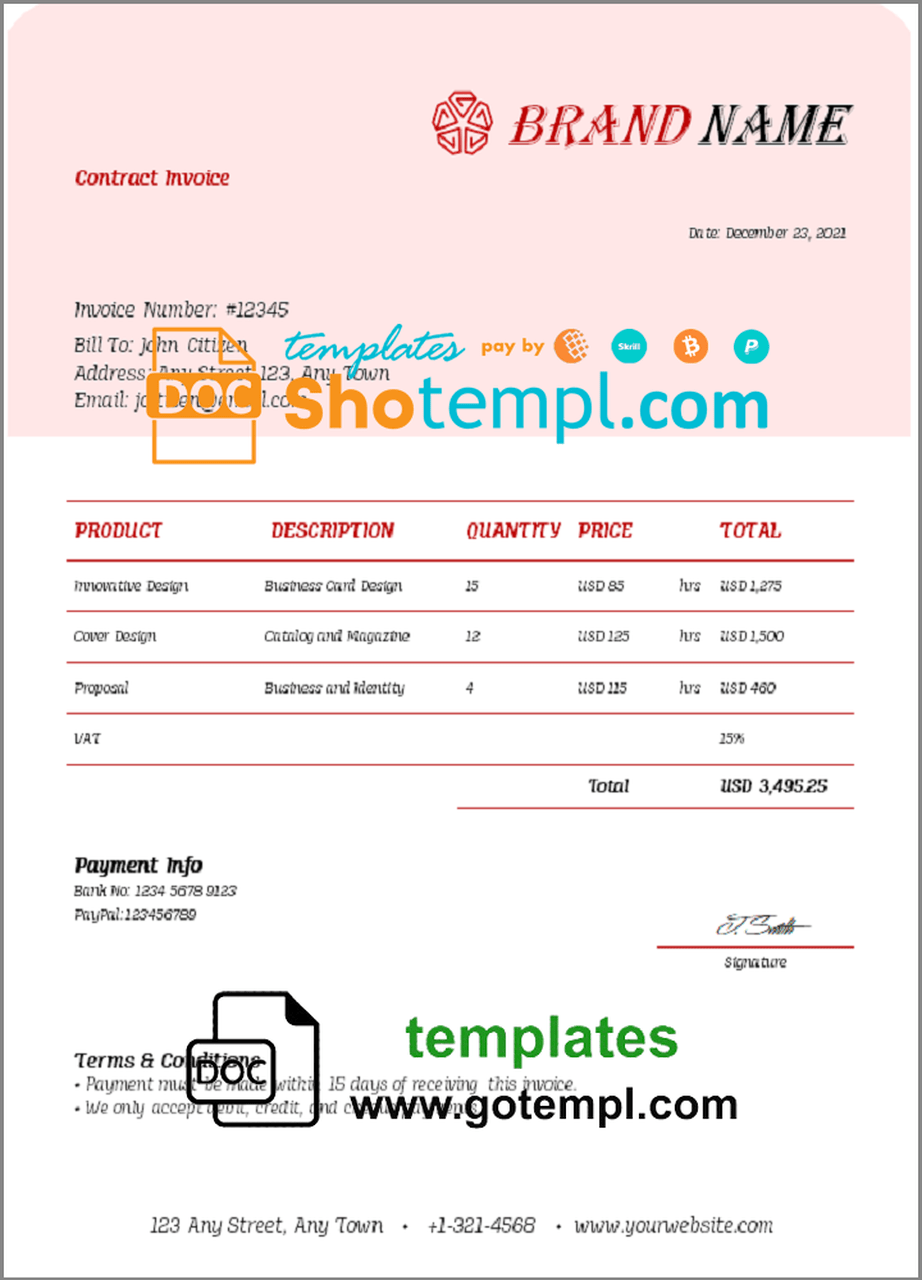

# head project universal multipurpose invoice template in Word and PDF format, fully editable  # zip key universal multipurpose invoice template in Word and PDF format, fully editable

# zip key universal multipurpose invoice template in Word and PDF format, fully editable