One of the most important tools in managing your finances is your bank account statement. It is a record of all the transactions you have made with your bank account, including deposits, withdrawals, and any fees or charges that you may have incurred. However, understanding the information contained in your bank account statement can be overwhelming, especially for those who are new to managing their finances. In this article, we will guide you through the basics of reading and interpreting your bank account statement.

What is a bank account statement?

A bank account statement is a summary of your account activity for a specific period. It is usually issued monthly, quarterly, or annually and includes information such as your beginning and ending balance, deposits, withdrawals, interest earned, and any fees or charges incurred during the statement period.

How to read your bank account statement?

To make the most of your bank account statement, you need to understand the different sections and what they represent. Here are some key elements of a bank account statement:

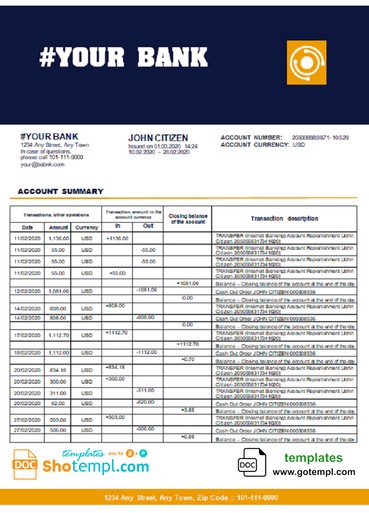

- Account Information: This section contains your account details, including your account number, account type, and the statement period.

- Beginning and Ending Balance: The beginning balance is the amount of money in your account at the start of the statement period, while the ending balance is the amount left at the end of the period after all transactions have been processed.

- Deposits and Credits: This section includes all the money you have added to your account during the statement period, including direct deposits, transfers, and deposits made through ATMs or mobile banking.

- Withdrawals and Debits: This section lists all the transactions that have reduced your account balance, including cash withdrawals, checks, debit card purchases, and automatic bill payments.

- Fees and Charges: This section includes any fees or charges associated with your account, such as monthly maintenance fees, ATM fees, or overdraft fees.

- Interest Earned: If you have a savings account or a high-yield checking account, you may earn interest on your balance. This section will show you how much interest you have earned during the statement period.

- Summary: This section provides a summary of all the transactions during the statement period, including the beginning and ending balance, total deposits, total withdrawals, and any fees or charges.

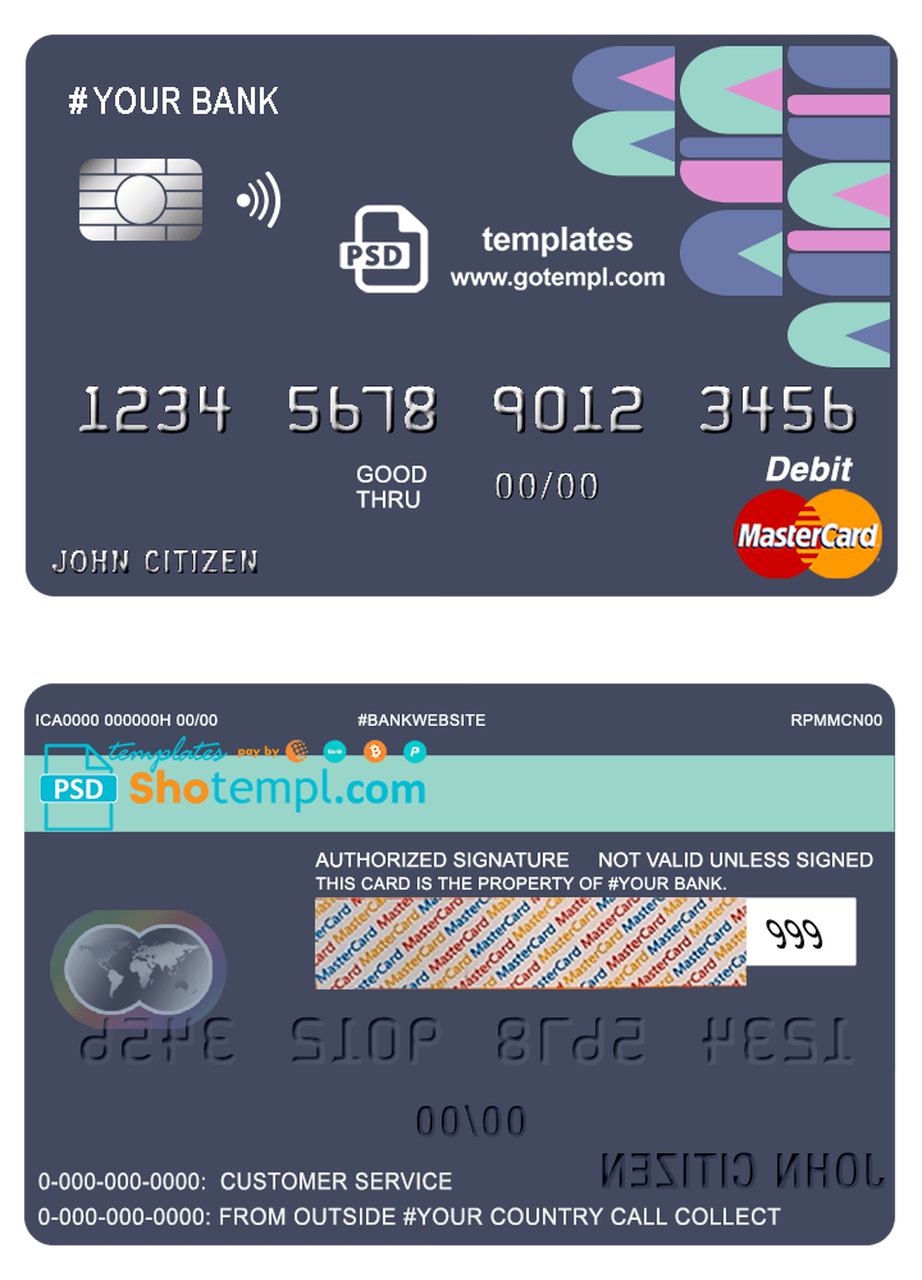

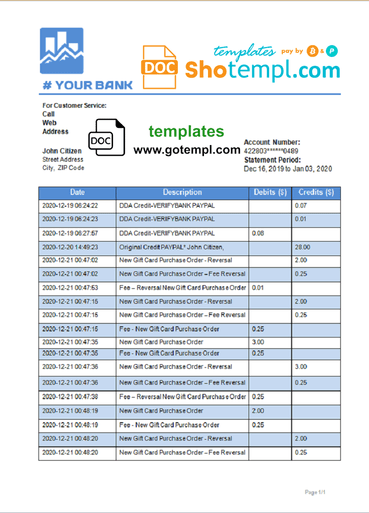

here’s an example

Tips for managing your finances using your bank account statement

- Review your bank account statement regularly to ensure that all transactions are accurate and that you have not been charged any unnecessary fees.

- Use your bank account statement to track your spending and identify areas where you can cut back on expenses.

- Take advantage of online banking and mobile apps to monitor your account activity in real time.

- Set up alerts to notify you of low balances, large transactions, or any unusual activity on your account.

- Use your bank account statement to reconcile your account, which involves comparing your statement to your personal records to ensure that they match.

download examples here: bank account statement

Conclusion

Your bank account statement is a valuable tool in managing your finances. By understanding how to read and interpret it, you can stay on top of your account activity, identify areas where you can improve your financial management, and ensure that you are not being charged unnecessary fees. Make sure to review your bank account statement regularly and take advantage of online banking and mobile apps to stay on top of your finances.

# action water universal multipurpose bank mastercard debit credit card template in PSD format, fully editable

# action water universal multipurpose bank mastercard debit credit card template in PSD format, fully editable  # BickSlow universal bank multipurpose statement template in Word format

# BickSlow universal bank multipurpose statement template in Word format  # alpine bear universal multipurpose bank visa electron credit card template in PSD format, fully editable

# alpine bear universal multipurpose bank visa electron credit card template in PSD format, fully editable  # art shadow universal multipurpose bank statement template in Word format

# art shadow universal multipurpose bank statement template in Word format  # awesome dreamcatcher universal multipurpose bank mastercard debit credit card template in PSD format, fully editable

# awesome dreamcatcher universal multipurpose bank mastercard debit credit card template in PSD format, fully editable  # artsy line universal multipurpose bank visa electron credit card template in PSD format, fully editable

# artsy line universal multipurpose bank visa electron credit card template in PSD format, fully editable  # bay piano universal multipurpose bank mastercard debit credit card template in PSD format, fully editable

# bay piano universal multipurpose bank mastercard debit credit card template in PSD format, fully editable  # abstractaza universal multipurpose bank visa credit card template in PSD format, fully editable

# abstractaza universal multipurpose bank visa credit card template in PSD format, fully editable  # azure bird universal bank multipurpose statement template in Word format

# azure bird universal bank multipurpose statement template in Word format  # bay piano universal multipurpose bank visa electron credit card template in PSD format, fully editable

# bay piano universal multipurpose bank visa electron credit card template in PSD format, fully editable  # amaze creative universal multipurpose bank visa credit card template in PSD format, fully editable

# amaze creative universal multipurpose bank visa credit card template in PSD format, fully editable  # blue leagcy universal multipurpose bank statement template in Word format

# blue leagcy universal multipurpose bank statement template in Word format  # absolute profit bank universal multipurpose bank account reference template in Word and PDF format

# absolute profit bank universal multipurpose bank account reference template in Word and PDF format