A bank savings account is a financial product offered by banks and other financial institutions that allows individuals to deposit and store their money while earning interest on their savings. It is a safe and convenient way to save money, and it provides easy access to your funds when needed. Savings accounts typically have lower interest rates than other investment options, but they also offer lower risk and greater liquidity, making them an ideal option for those who are looking to save money for short-term goals or emergencies. Many banks offer online access to savings accounts, allowing you to manage your account from anywhere with an internet connection. Savings accounts are often used to save money for short-term goals or emergencies, as they offer liquidity and flexibility. Many banks offer online access to savings accounts, allowing you to manage your account from anywhere with an internet connection.

Benefits of bank account savings

First and foremost, bank savings accounts are an excellent tool for building an emergency fund. Life is unpredictable, and unexpected expenses can arise at any time, from car repairs to medical bills. Having a savings account can help you weather these financial storms without having to rely on credit cards or other high-interest loans.

Another benefit of a bank savings account is the ability to earn interest on your money. While interest rates may be low at the moment, it’s still better than keeping your money under a mattress or in a piggy bank. Over time, the interest earned on your savings can add up, providing you with additional funds for future purchases or investments.

Savings accounts are also an excellent way to teach children about the importance of saving and financial responsibility. By opening a savings account for your child and encouraging them to contribute regularly, you can help instil good financial habits that will benefit them throughout their lives.

When choosing a bank savings account, it’s important to consider the interest rate, fees, and account features. Some banks offer higher interest rates than others, while some may charge fees for maintaining the account. You should also look for features such as online banking and mobile apps, which can make it easier to manage your savings and monitor your account activity.

Here are some additional details about bank savings accounts:

- Security: One of the primary benefits of a bank savings account is that it provides a safe and secure way to store your money. Banks are highly regulated and must adhere to strict security protocols to protect your funds. Additionally, most savings accounts are FDIC-insured, which means that your deposits are insured by the federal government up to a certain amount (currently $250,000 per depositor per bank).

- Easy access: Savings accounts are designed to provide easy access to your funds. Most banks offer online access to savings accounts, allowing you to manage your account from anywhere with an internet connection. Additionally, most savings accounts allow you to make withdrawals or transfers to your checking account or other accounts at the same bank.

- Low risk: Savings accounts are considered a low-risk way to save money. While the interest rates may be lower than other investment options, such as stocks or mutual funds, savings accounts offer a stable and predictable return on your investment. They are also backed by the FDIC, which provides an additional layer of protection.

- Flexibility: Savings accounts offer flexibility in terms of how you can use your funds. Unlike other investment options that may have restrictions or penalties for withdrawing your money early, savings accounts allow you to access your funds at any time without penalty.

- Goal-oriented savings: Savings accounts are often used to save money for short-term goals, such as a vacation, down payment on a home, or emergency fund. Many banks allow you to set up automatic transfers to your savings account, making it easy to save money regularly.

Overall, a bank savings account is a safe, easy, and low-risk way to save money and earn interest on your savings. With easy access, flexibility, and goal-oriented savings options, it’s a great option for anyone looking to build their savings.

In conclusion, a bank savings account is a great tool for anyone looking to save money and earn interest on their savings. With the benefits of security, easy access, low risk, flexibility, and goal-oriented savings options, a savings account provides a safe and reliable way to store your money and make it work for you. By depositing your money into a savings account, you can enjoy peace of mind knowing that your funds are secure and easily accessible, while also earning a stable and predictable return on your investment. Whether you’re saving for a short-term goal or building an emergency fund, a bank savings account is a valuable financial tool that can help you reach your financial goals.

If you want to explore more about bank account savings click here: bank account savings

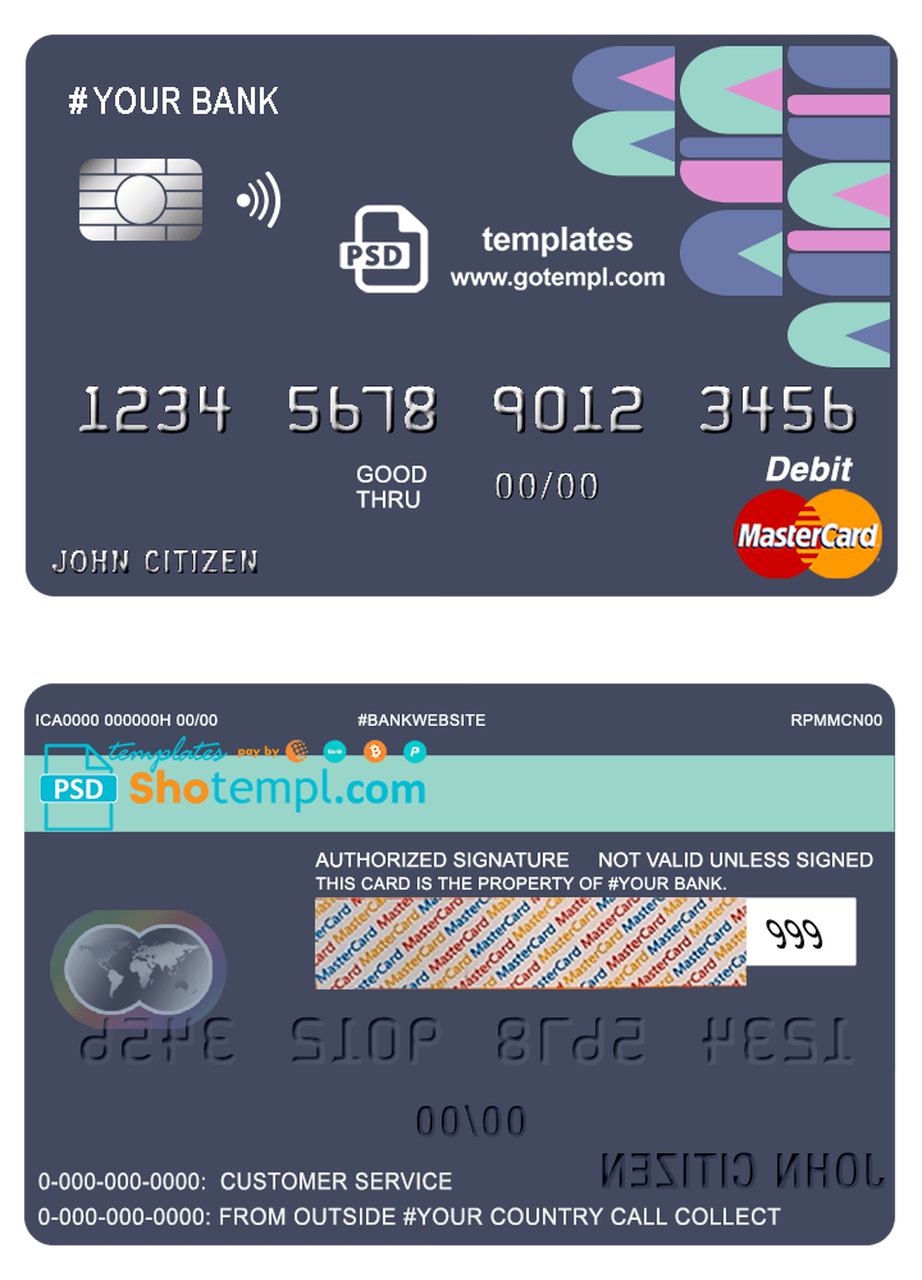

# alpine bear universal multipurpose bank mastercard debit credit card template in PSD format, fully editable

# alpine bear universal multipurpose bank mastercard debit credit card template in PSD format, fully editable  Albania Albanian Power Corporation utility bill template in Word and PDF format

Albania Albanian Power Corporation utility bill template in Word and PDF format  # amaze creative universal multipurpose bank mastercard debit credit card template in PSD format, fully editable

# amaze creative universal multipurpose bank mastercard debit credit card template in PSD format, fully editable  # action water universal multipurpose bank visa electron credit card template in PSD format, fully editable

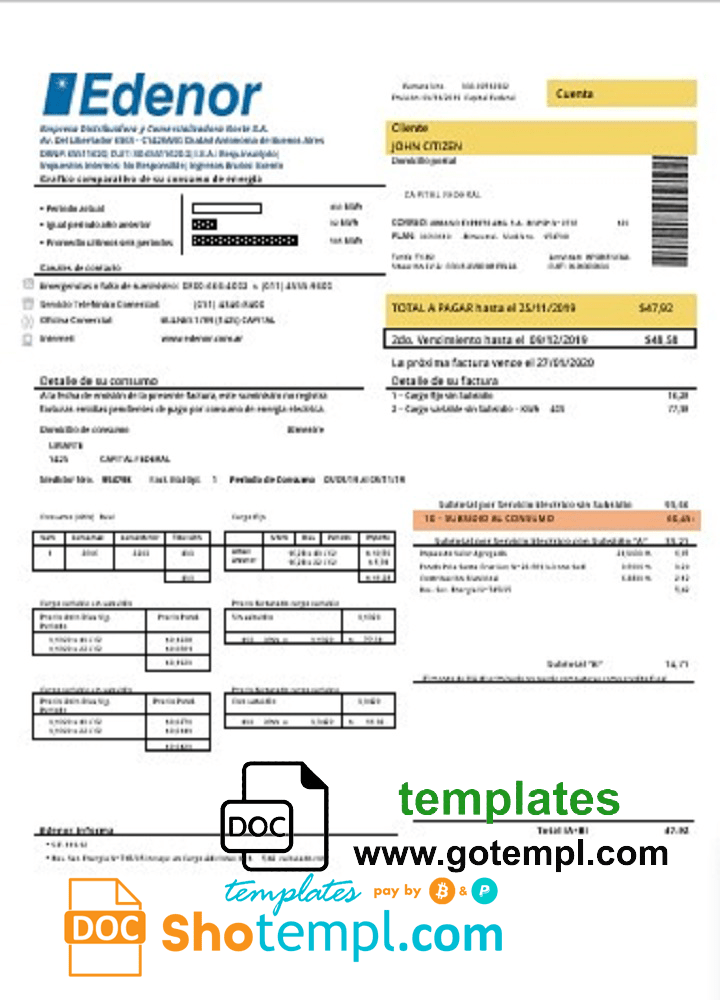

# action water universal multipurpose bank visa electron credit card template in PSD format, fully editable  Argentina Edenor easy to fill utility bill template in Word (.doc) and PDF (.pdf) format

Argentina Edenor easy to fill utility bill template in Word (.doc) and PDF (.pdf) format  # action water universal multipurpose bank mastercard debit credit card template in PSD format, fully editable

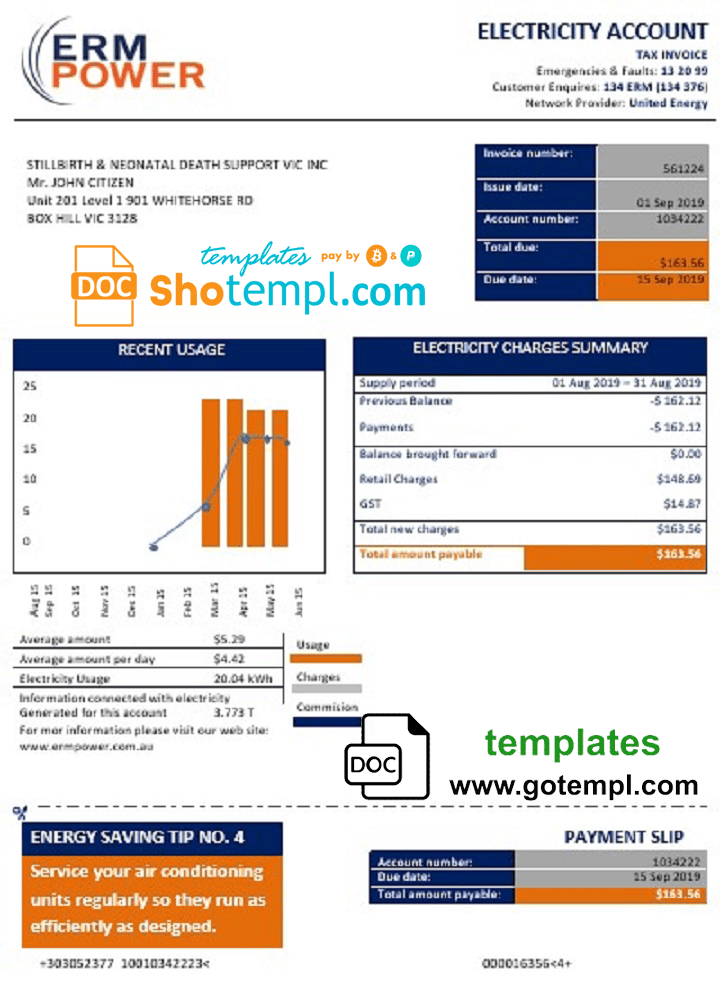

# action water universal multipurpose bank mastercard debit credit card template in PSD format, fully editable  Australia ERM Power electricity proof of address utility bill template in Word and PDF format

Australia ERM Power electricity proof of address utility bill template in Word and PDF format  Australia Imagine Time utility bill template in Word and PDF format

Australia Imagine Time utility bill template in Word and PDF format  # abstractsio universal multipurpose bank visa credit card template in PSD format, fully editable

# abstractsio universal multipurpose bank visa credit card template in PSD format, fully editable  # abstractsio universal multipurpose bank mastercard debit credit card template in PSD format, fully editable

# abstractsio universal multipurpose bank mastercard debit credit card template in PSD format, fully editable  # absolute profit bank universal multipurpose bank account reference template in Word and PDF format

# absolute profit bank universal multipurpose bank account reference template in Word and PDF format  # blue leagcy universal multipurpose bank statement template in Word format

# blue leagcy universal multipurpose bank statement template in Word format  # baloon bio universal multipurpose bank mastercard debit credit card template in PSD format, fully editable

# baloon bio universal multipurpose bank mastercard debit credit card template in PSD format, fully editable  # amaze creative universal multipurpose bank visa credit card template in PSD format, fully editable

# amaze creative universal multipurpose bank visa credit card template in PSD format, fully editable  # bay piano universal multipurpose bank visa electron credit card template in PSD format, fully editable

# bay piano universal multipurpose bank visa electron credit card template in PSD format, fully editable